Despite the economic slowdown, startup accelerators continue to play a crucial role in the entrepreneurial ecosystem, providing startups with the necessary resources and guidance to grow and scale.

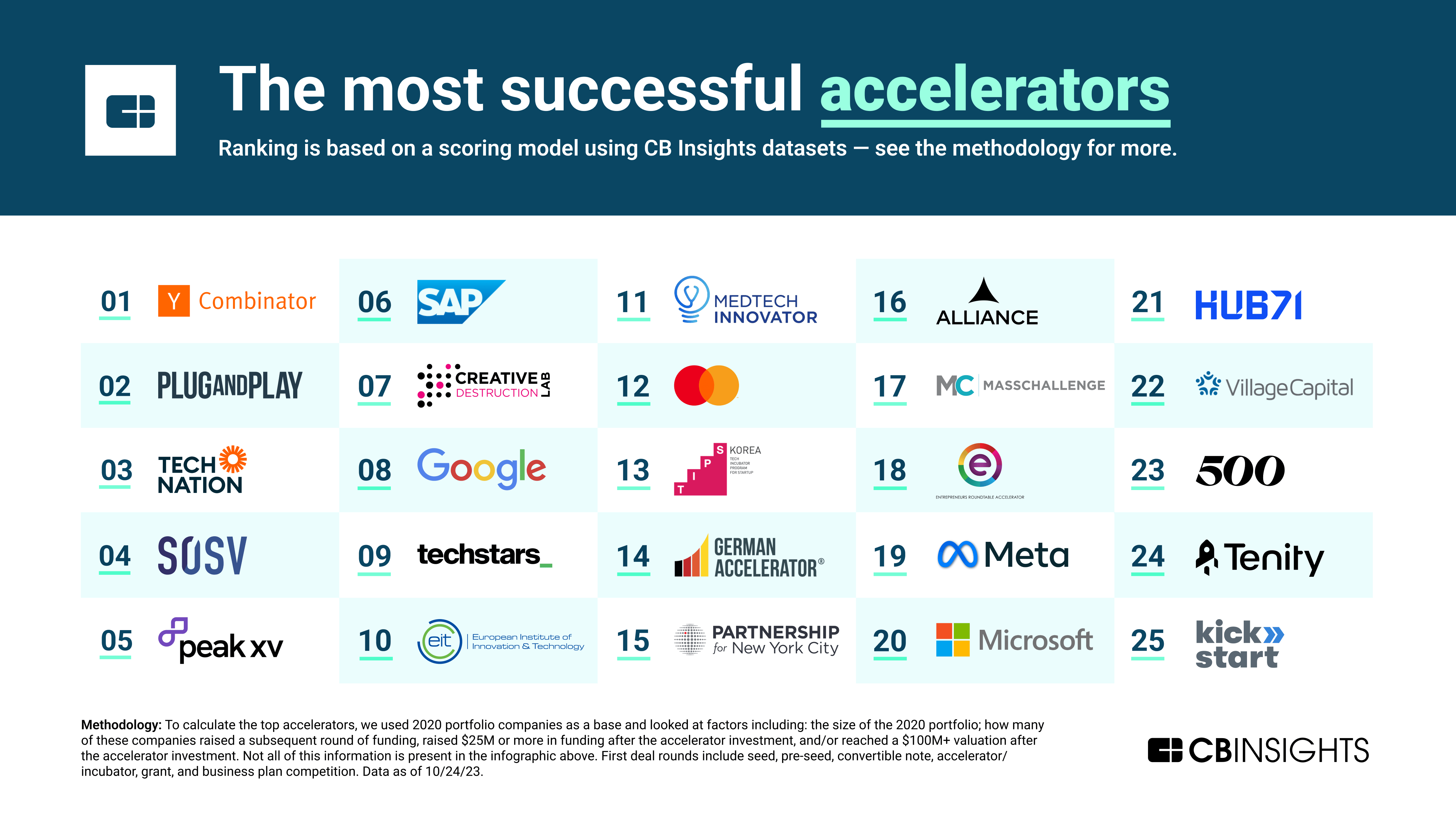

However, not all accelerators are created equal. CB Insights has ranked the top 25 most successful startup accelerators based on their portfolio strength and performance, using the 2020 investment class as a basis.

Notable examples from that list include:

- Y Combinator and Plug and Play lead in the broad investing approach, their 2020 alumni making up one-third of all portfolio companies included in this analysis. Nearly half of their 2020 alumni have since received follow-on investments, and 5%-10% of each accelerator’s 2020 class has raised $25M+ or reached $100M+ valuations post-accelerator round.

- SAP’s SAP.iO Foundry and the Surge accelerator from Peak XV Partners (formerly Sequoia Capital India & SEA) shine with $25M+ fundraisers or $100M+ valuations, despite smaller 2020 portfolios. Notably, Surge holds the highest follow-on investment rate on the list at 83%.

- Corporate accelerators like Google, Mastercard, Meta, and Microsoft recorded high rates of $25M+ fundraising, $100M+ valuations, or both among 2020 alumni. This suggests these accelerators give portfolio companies a boost from the brand recognition of their parent organizations.

Read the article at The top 25 most successful startup accelerators - CB Insights Research

Categorisation

Type of document

Document

Attachment

Login or

create an account to comment.