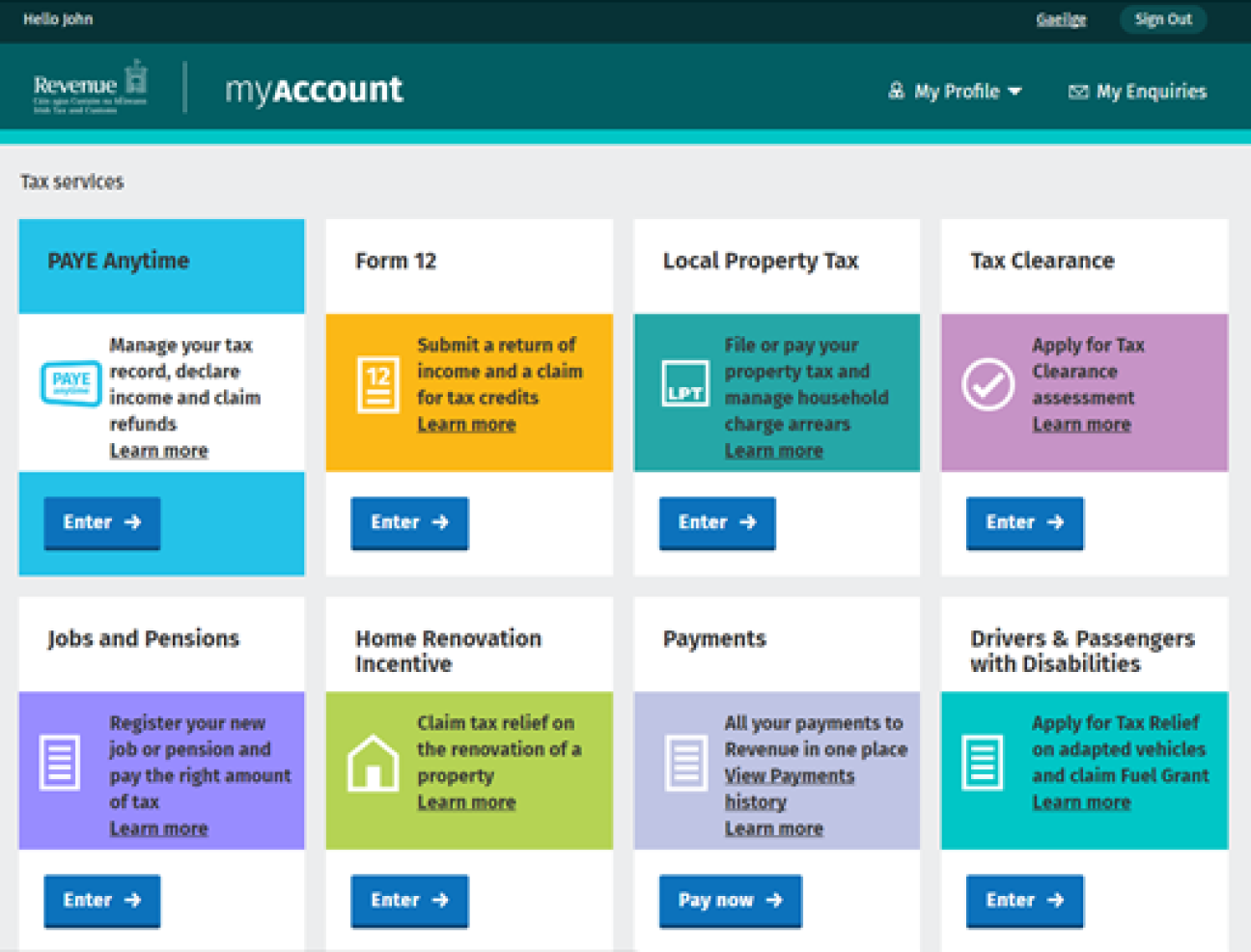

Ireland was an early adopter of secure online services for tax and customs administration. The Revenue Online Service (ROS), aimed at businesses and self-employed, was launched in 2000. In 2005, online services were extended to the wider Pay-As-You-Earn (PAYE) taxpayer base. Since then, additional services and Government initiatives have further widened the user base. This led to the development of the myAccount portal. This service serves as a single point of access for secure online services (excluding ROS) such as PAYE Anytime, Local Property Tax (LPT), Home Renovation Incentive (HRI) and many more using a single login and password.

myAccount is a responsive, intuitive service allowing customers to interact with Revenue on the device of their choice at a time that is the most convenient for them. This is a quick, easy, secure and convenient way for Irish citizens to self-manage their tax affairs, and allows them to access PAYE Anytime and other online services. Provision of a secure and reliable service is a key underpinning of the myAccount service.

The Office of the Revenue Commissioners is the Ireland’s competent authority for assessing, collecting and managing taxes and duties. Revenue is committed to making the myAccount service accessible to all people, regardless of their capability. A key strategic priority for the administration is to make it easier and less costly for taxpayers to voluntarily comply with their tax and duty obligations. Through the use of Government data to verify a customer’s identity in real-time, many customers can now retrieve their password immediately by text or email. As additional data becomes available to Revenue, more customers will be able to register and access myAccount instantly.

Policy Context

The portal makes it easier and less costly for customers to voluntarily comply by providing a single secure access point to a wide range of self-services to 2.4 million PAYE and Local Property Tax customers.

Revenue is committed to participating in the program to extend the scope of shared services across the public sector, a key component in the Government’s strategy to improve public services.

Description of target users and groups

myAccount is only available to individuals who do not hold an active digital certificate for ROS. Business customers (having an active digital certificate for ROS) can access all the relevant services appropriate to them within ROS.

Description of the way to implement the initiative

The myAccount portal allows Revenue to add new services and introduce new features quickly and seamlessly to the customer using the same easy-to-use interface. myAccount also permits relevant options to be displayed to customers based on their individual circumstances. There are plans to further personalise and streamline the options offered.

For example, in June 2016 Revenue introduced a new secure online payments facility, which enables a customer to make a Tax, Interest and Penalty payment. There are five distinct payments types that can be paid online using myAccount:

- Tax- Customers select this option to pay 23 separate taxes;

- Interest - Customers select this option to make any interest payment;

- Penalty – Customers select this option to make any penalty related payment, for example Audit or Non-Filer;

- Attachment – Customers use this option to pay a ‘third party’ debt that has arisen on foot of a Notice of Attachment from Revenue;

- Audit – Customers use this option to pay tax liabilities that have arisen on foot of a Revenue audit and where the exact tax/periods is not yet fully agreed with the Auditor. Once the Audit is concluded/agreed the system will reallocate the amounts accordingly.

Customers have a facility on the home page of myAccount to view their payments history. It lists and sorters all the payments that have been made by date, payment type and amount.

Technology solution

myAccount uses state-of-the-art technologies and is accessible from all mobile devices. Between September 2015, when it went live, and the end of the year there were over 450.000 logins accessing almost 900.000 application services. myAccount won a 2015 Irish Civil Service Excellence and Innovation Award.

In order to be fully accessible to the wider public, the myAccount service has been designed following Web Content Accessibility Guidelines (WCAG). WCAG AA covers a wide range of recommendations for making Web content more accessible for all user agents, including people with different types of disabilities. The “AA” level of WCAG, used as a guideline for creating MyAccount portal, deals with the highest level barriers for disabled users.

Main results, benefits and impacts

The benefits of using myAccount include:

- Quick, convenient, easy and secure service;

- 24 hours a day, 365 days a year accessibility;

- Single password for all online services;

- Instant retrieval of forgotten passwords (in most cases);

- Accessible using multiple devices (desktop computer, smartphone, tablet etc.);

- Updating of profile details, including change of address.

Lessons learnt

Revenue has developed a new secure online payments facility via myAccount, which enables a customer to make a Tax, Interest and Penalty payment. Through the use of Government data to verify a customer’s identity in real-time, many customers can now retrieve their password immediately by text or email.

The main objectives of this single secure access point are to:

- Assist customers to meet their tax obligations and claim their entitlements at a time and place that is suitable to them and on a device of their choice;

- Increase the level of usage of the Irish online services through an intuitive, user-friendly access point;

Significantly improve the registration process for online services with the provision of instant passwords via text or email where it is possible to validate a person’s identity in real-time.

Scope: National